Renters Insurance in and around Huntsville

Huntsville renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your valuables matter and so does their safety. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your clothing to your boots. Wondering how much coverage you need? That's okay! Lara Bryant is here to help you evaluate your risks and help secure your belongings today.

Huntsville renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

There's No Place Like Home

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps protect your personal possessions in case of the unexpected.

More renters choose State Farm® for their renters insurance over any other insurer. Huntsville renters, are you ready to see how helpful renters insurance can be? Contact State Farm Agent Lara Bryant today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Lara at (256) 852-8205 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

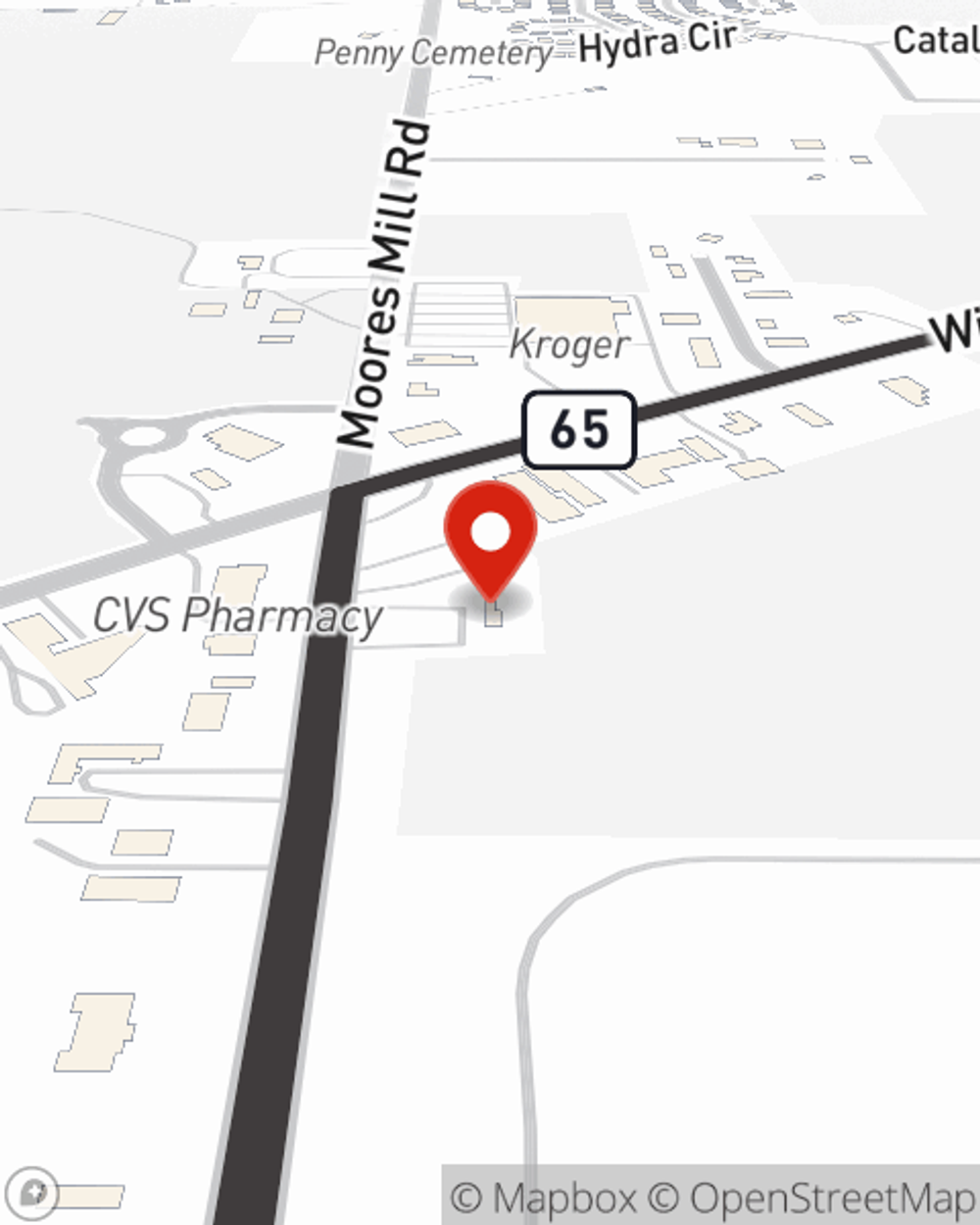

Lara Bryant

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.